.png)

CEO of the Year

Kuflink is a family made up of many stakeholders, including our team, investors, employees, partners, etc. We thank them and all those who have supported us.

Investors' choice

This is an outstanding accolade to be voted the best Peer to Peer (P2P) platform by Investors from all P2P platforms. We are looking forward to 2023 with many more features in the pipeline.

Bridging lender of the Year

The Bridging team is exceptional in experience and talent. Lending is an art form which we have ingrained in our proprietary technology.

Kuflink's Purpose is to Connect People to Financial Freedom

"I have been investing in Kuflink since early 2018. The website and structure of investing are simple to understand and use. In this time I have made many investments and always received the interest due. I like the company’s good communication with regards to my investments (regular updates) and the good returns that I receive on them. The main reason I invest with Kuflink is, unlike a lot of “crowdfunding” sites, that my investment is secured against fixed assets, so in the event of a problem, there is recourse. In addition, Kuflink themselves invest their own money in each “deal” on offer, which gives me a lot of confidence in the products even in these difficult times."

Phil

OCTOBER 2021

"I am a seasoned investor with accounts with 14 UK peer-to-peer lending platforms. The fact that my loans with Kuflink are all asset-backed, usually with first-charge security, over properties and/or land in the UK gives me peace of mind. The interest returns are generous. Most importantly, I have never lost a penny with any of my investments on Kuflink. The customer service is exceptional. The staff are friendly, on the ball, and always go the extra mile. Kuflink have grown to become my favourite P2P lending platform. Such is my confidence in the company that I have loaned £541,946 via them in the last six months."

David

OCTOBER 2021

"I have been investing with Kuflink for just over three year now and I am delighted with the results. It’s simple to use and understand, and I particularly like being able to choose individual properties myself. The staff are readily available to help with any questions, or advice needed and they will keep investors updated on your investments. The web site is easy to use and understand, making the investing with Kuflink something anybody can do.The fact that interest is paid monthly means you can see how well your investments are doing."

Greg Davis

December 2020

"I've used Kuflink for about three years now for both business and personal funds. When deposit rates continued to fall I looked to get a better return on cash. Peer to peer lenders were the obvious choice and Kuflink has proved to be a sound choice. Interest rates are excellent, and what I like in particular is that all loans are backed by property with sensible LTV rates, giving a very good level of security. The company invest alongside investors as well. Communications from Kuflink are excellent, and even in the difficult year we've just had, there have been no significant issues. I hate the term 'no brainer' but with deposit rates at a fraction of 1%, Kuflink is a great home for cash you're prepared to tie up for the next 12-18 months."

John Harrison

December 2020

.png)

"I have been investing in Kuflink since early 2018. The web site and structure of investing is simple to understand and use. In this time I have made many investments and always received the interest due. I like the company’s good communication with regards to my investments( regular updates) and the good returns that I receive on them.The main reason I invest with Kuflink is ,unlike a lot of “crowd funding” sites, that my investment is secured against fixed assets, so in the invent of a problem there is recourse. In addition Kuflink themselves invest their own money in each “deal” on offer This gives me a lot of confidence in the product even in these difficult times."

Phil Richardson

December 2020

"Like many, I was nervous about a “different” type of investment. But the Kuflink approach and professionalism has assuaged my worries and means my limited investment pot grows at a better rate than banks etc.The loans being secured on property was an initial security – and then in speaking to the team it was explained that Kuflink also put in a percentage of the company’s money – so it’s in everyone’s “interest” to ensure repayment – and I’ve never been let down – although sometimes it can take a little longer than the original agreed period – especially during the current strange times.Thanks Kuflink – keep doing what you do!"

Victoria Courtney

December 2020

"I was looking for a better return on my investments than the paltry interest rate my bank is offering. I have been really pleased with the interest rates offered by Kuflink. I also really appreciate the personal service which is excellent. I know from talking to you that your company takes due-diligence very seriously when choosing individuals or companies to lend money to. That is very reassuring."

Madeline Harrison

December 2020

"I came across Kuflink 3 years ago when trying to help a client repay their existing facility with them. I’ve never thought to use them previously but the way in which they handled this situation really impressed me. They had the client's best interests at heart when trying to find a solution. They worked on 3 different solutions to help the client. I found this so refreshing, having dealt with lenders whose main aim is to acquire assets, and it was something I wanted to align myself with. I found synergy in our principles and the way we work, putting the client first and always trying to find solutions. I always research the market for each deal, I present terms from a number of lenders, comparing rates, terms criteria as well as service. Each time they come out on top and prove why I recommend them on a daily basis. Having that trust with our lending partners as well as clients is key to any successful working partnership. Having now completed many transactions with Kuflink, they are without a doubt one of our top 5 lenders to work with and always rank in our market research when sourcing new facilities for clients."

Adele Turton (Blanc Property Finance)

June 2022

"I approached Kuflink Bridging to complete on an auction purchase for a 100% facility with additional security offered. Mr Jeff Bungar was extremely helpful and co-ordinated the advance in good time for the 28-day completion deadline. I would not hesitate to recommend Kuflink Bridging Finance to my colleagues who need fast delivery of funds to meet their deadlines. Thank you."

Pradeep Mehta

January 2021

"Thank You to Kuflink. We would like to thank Kuflink, who provided us with a friendly and flexible service in providing bridging finance for our development project at Honister Gardens. This project was originally due to last for 26 weeks, with building work having commenced in May 2019 and finance from Kuflink was due for a period of 12 months. This project took longer than planned, being completed in January 2021 and we needed to extend the loan agreement three times. Bridging lenders tend to have a bad reputation, however, this was not our experience with Kuflink. Each time we needed to extend the loan period or raise additional finance we found them to be approachable, understanding and easy to work with. In addition to the funding, Kuflink recommended a project management/employers agent service that we found to be very useful in assisting with things such as valuations and construction issues throughout the project and this helped contribute to its success. I would certainly wholeheartedly recommend Kuflink for the way they go the extra mile. We now have a completed project that we are extremely happy with!"

Deborah Pinnock-Daley - Operations Director, Striving For Independence Care

January 2021

"In our experience, Kuflink were quick to make a decision and efficient in their credit checks and enquiry’s, and all this when even the high St banks were caught up in deliberating and hesitation. "

Tony Pritchard I.R.P.M Managing Director

JANUARY 2021

"I took Bridge Loan from Kuflinks to purchase property in Gravesend. All Kuflink staff were professional and accommodating. My purchase went through very smoothly. All my emails were replied on the same day. I thank everyone at Kuflink."

Gurvinder Singh Saluja

JANUARY 2021

"I have dealt with Kuflink as a borrower and lender. From both aspects, they were professional at all times. As a borrower, every 't' was crossed and every 'i' was dotted, and if I ever need funding again, there is only one organisation I would approach. Also, as a lender, Gurbinder was 100% professional with no sales pressure and clearly outlining all aspects of the transactions. For my company, there will only be one place to go - Kuflink."

David Hunter (Torpedo South Ltd)

December 2020

The next generation of

property investments have arrived

How it works

Register

It's quick and easy to setup your account, and top up your Kuflink wallet.

Invest

Choose the specific deal you'd like to invest in (Select-Invest), or have us diversify your portfolio across a range of deals; we call that Auto-Invest.

Earn

Sit back and receive your interest, or alternatively choose to compound and receive more at the end of the loan term.

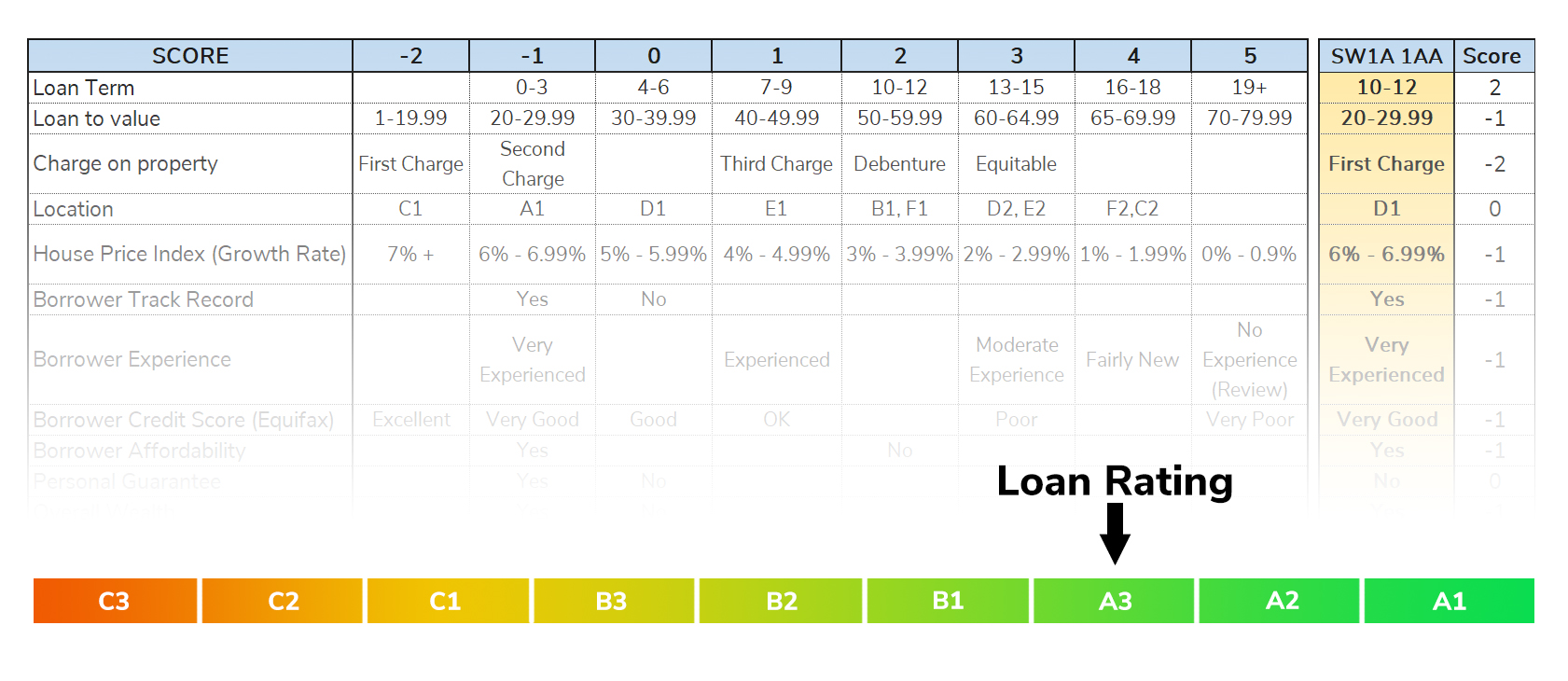

Comprehensive Deal Information

Available to Invest

Rating:

Available to Invest

Rating:

Available to Invest

Rating:

Three unique ways to

Earn more interest

Select-Invest

Choose individual property-backed* business projects to fund, from as little as

£100.

Earn up to 9.8% pa*†

Auto-Invest

We'll spread your investment across a range of deals, so you can diversify your portfolio and spread your risk.

Earn up to 8.21% pa*†

IF-ISA**

Invest your tax free allowance within our Innovative Finance ISA across 1, 2 or 3 year terms.

Earn up to 9.8% pa*†

Why Investors

Love Us

For our expertise

Our in-house team of property and finance experts form a robust lending committee who rigorously assess every loan.

To earn a greater return on their money

Every deal on the platform offers attractive returns of up to 8.95%*† pa so you can watch your money grow quicker*.

Figures correct as of 31st May 2025

|

||||

|

||||

|

||||

|

||||

|

||||

|

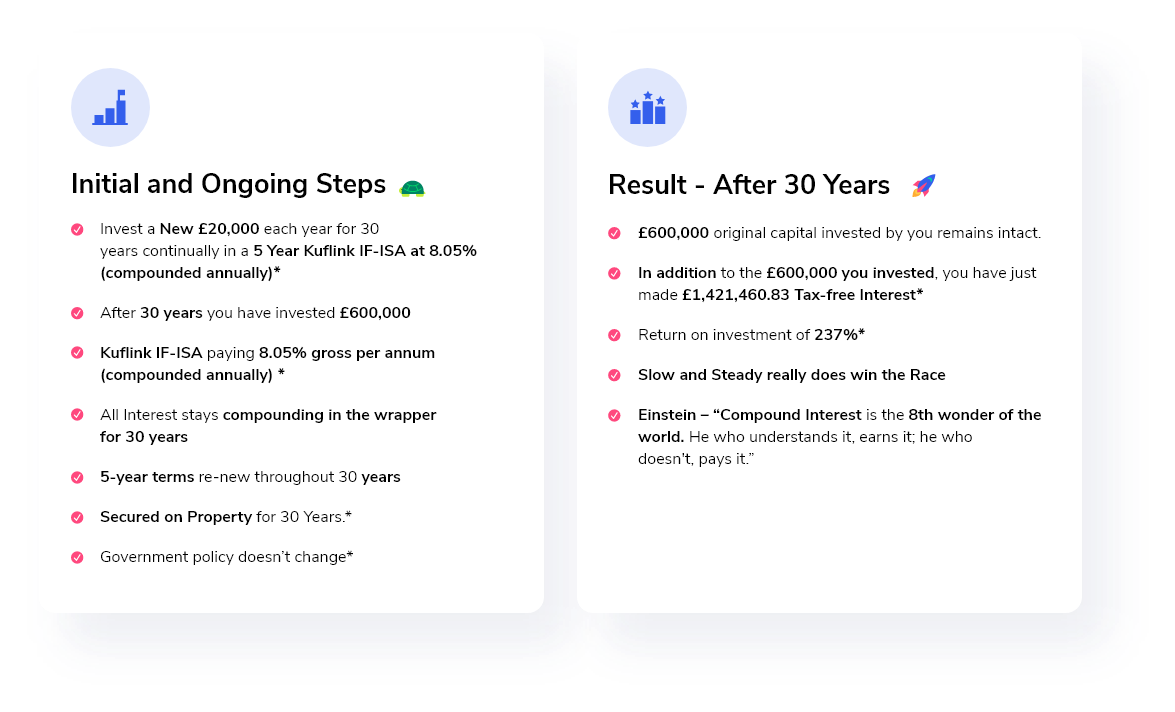

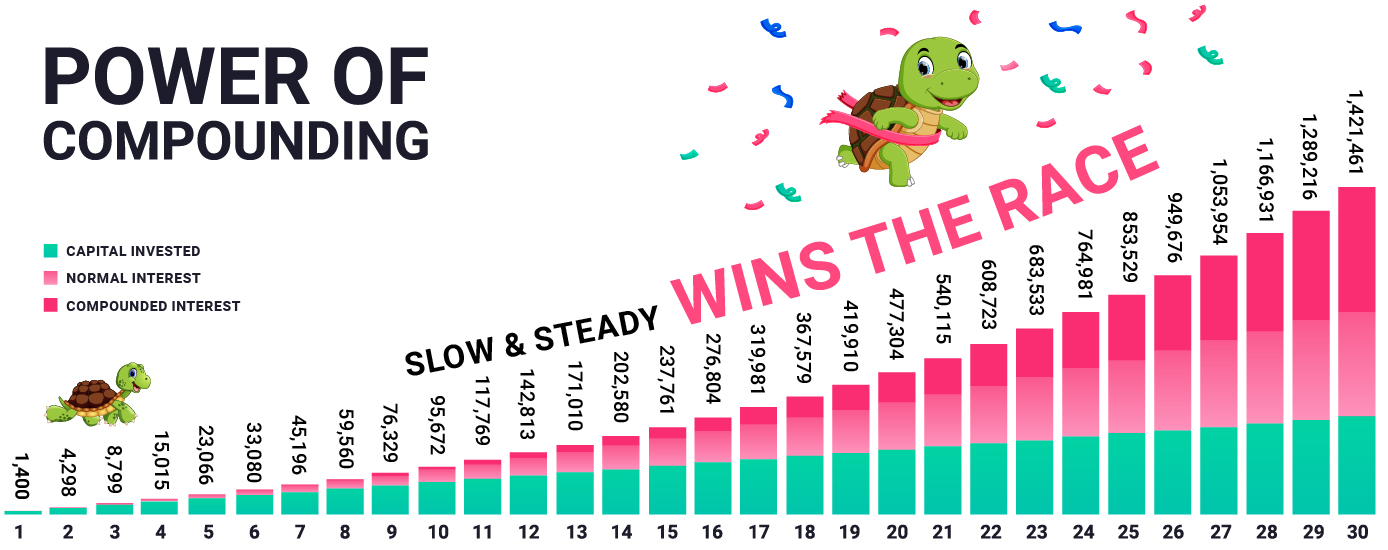

Kuflink's £1m Tax-Free Interest Model

We would like to share the following model to show you how to earn over £1m in Interest, Tax-free.

Our Accountants, Compliance and Tech teams brainstormed in the boardroom and discovered a way to make over £1m net Tax-free interest using the Kuflink IF-ISA model*. Being Tax-Free, this boosts your returns by compounding the tax-free earnings that you can then watch grow exponentially over time. Kuflink's IF-ISA fits this model.

Consider the following to earn £1M TAX-FREE from Kuflink's 5-Year IF-ISA at 8.05% (compounded annually)*. (The concept works on smaller amounts as the percentage return is the same).

Dedicated Investor

Relations Support

Alternatively, speak with the team via live chat on Kuflink.com.

16Jan

Kuflink Soars: Doubling Profits and Delivering...

We're thrilled to announce a record-breaking year for Kuflink, the award-winning financial lender you trust.

09Oct

IF-ISA, beginner's guide to earning £1m Interest...

Earn £1m Interest Tax-free, using a simple UK Tax idea.*

09Oct

Is Peer to Peer Lending Safe? Coffee with...

As Head of Collections for Kuflink, and armed with 30 years of banking experience, I have taken to this department like a duck...

Download a Free IF - ISA Guide

Subscribe to the Kuflink Peer to Peer Investment Blog and get your FREE Ebook today:

'Individual Saving Accounts' ('ISA's') where you can earn Interest TAX-FREE.

8 reasons why kuflink!

-

- We co-invest up to 5% alongside you, subject to criteria (Select-Invest only)

- Secured Loans*

- Independently AUDITED Accounts since 2014 (Kuflink Group Limited)

- P2P Platform (Kuflink Ltd) profitable since 2020

- Bridging Loans since 2011 & Online P2P Platform since 2017

- Blended LTV & LTGDV circa 65%

- Loan book monitored daily by our in house collections team

- Collections use 30 day Default rule v 180 day FCA Default rule

Kuflink Awards

.png?width=200&height=91&name=Gold%20Member%20Badge%20-%20highres%20(1).png)